- On April 01, 2015

- In Advice

Getting Ready for Tax Day

IBA offers help to all of their residents by providing them with legal and administrative assistance. Following this notion, we believe that everyone should be prepared with the tools they need to navigate the taxing system with ease.

With two weeks before Tax Day on April 15th, it’s a good idea to get a refresher or just some tips for the most efficient ways of filing your taxes. There are online services through IRS which help you for free, and others like Turbo Tax which make the process easy, but have a fee.

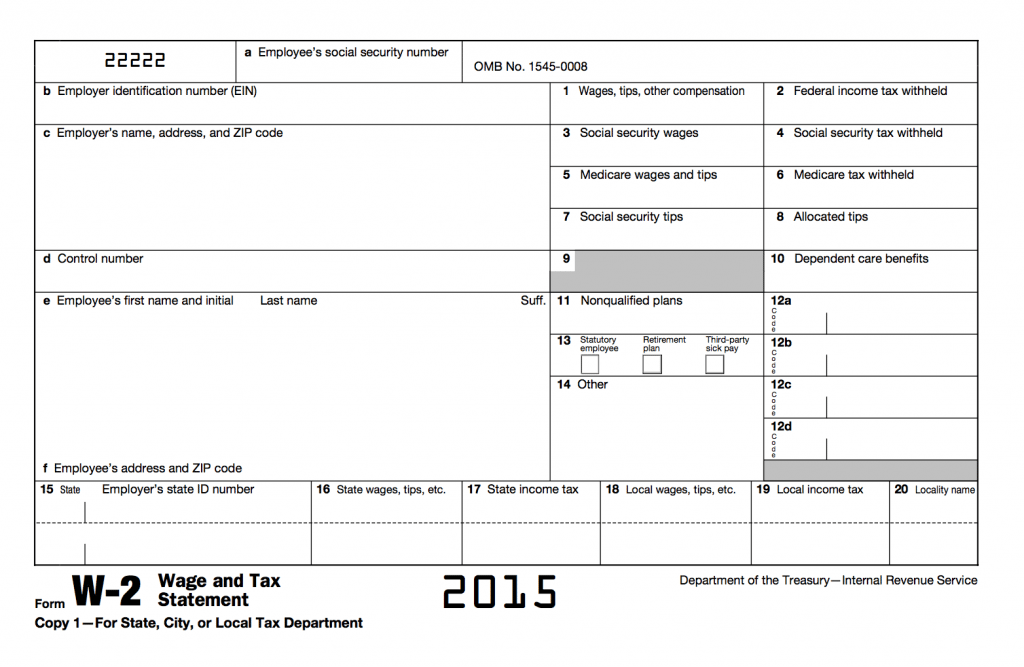

First you should determine whether you actually need to file a tax return. Here the IRS can help you figure that out by asking a set of questions. The information you will need is: your filing status, federal income tax withheld, and other basic information to help you determine your gross income. Thus, it’s important to keep documents such as your W-2s, 1099s, and records of any possible deductions such as tuition, spouse and dependents, mortgage interest and real estate taxes, charitable contributions, and medical expenses organized and ready to go.

Your filing status dictates filing requirements, standard deduction, eligibility for certain credits, and your correct tax. It is possible that more than one filing status applies to you. To make sure you use the one that will result in the lowest amount of tax you can do this interview. Like the tax return one, it asks a set of questions, mostly about the cost of keeping up your home, and then chooses the most beneficial for you.

If you’re submitting your forms online you will need an electronic pin which you can also find at the IRS page. If you’re not ready to file your taxes by April 15th, you can apply for an extension by filling out this form and mailing it to the corresponding P.O Box specified at the bottom.

Now it’s important to keep in mind that there are several life events that can have an effect on your taxes such as the birth of a child, divorce or marriage, job loss, retirement, etc. Here is a detailed list with each of their tax impacts explained.

With all this information you are ready to start your filing process by picking one of the free software outlined above. Each of them varies, so it is important to read through all of them and find the one that best applies to you.

Best of luck!

...

Your filing status dictates filing requirements, standard deduction, eligibility for certain credits, and your correct tax. It is possible that more than one filing status applies to you. To make sure you use the one that will result in the lowest amount of tax you can do this interview. Like the tax return one, it asks a set of questions, mostly about the cost of keeping up your home, and then chooses the most beneficial for you.

If you’re submitting your forms online you will need an electronic pin which you can also find at the IRS page. If you’re not ready to file your taxes by April 15th, you can apply for an extension by filling out this form and mailing it to the corresponding P.O Box specified at the bottom.

Now it’s important to keep in mind that there are several life events that can have an effect on your taxes such as the birth of a child, divorce or marriage, job loss, retirement, etc. Here is a detailed list with each of their tax impacts explained.

With all this information you are ready to start your filing process by picking one of the free software outlined above. Each of them varies, so it is important to read through all of them and find the one that best applies to you.

Best of luck!

...